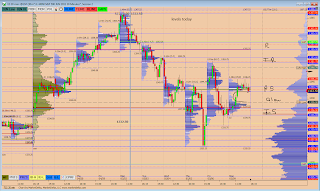

Trade plan and Price action review: (Price action review). The day opened a little above value and proceeded to go lower looking for buyers, we tested the previous day’s highs and the 1346.25 level where responsive buyers were active. This was a good area to get long at. We then traded up into the 1351-1353 level on my chart and ticked off there on a negative tick divergence and also a VB div. This was a good area to look for shorts to play a rotation back down if you were looking for that. We ticked down for a few points and found support at 1348.00 and bounced from there. Once price didn’t make it to the lows of the day for the rotation you had to start thinking that a break above was likely. So this would have kept you safe from the short side. The market chopped for a bit building out the vpoc. We tested down to the 1348 level again and buyers were still active. This would have also been good for a long again. We traded higher and broke the 1351-1353 level. I was expecting a fast break of this area as there were a lot of stops sitting above the 1352 level. I knew there were a lot of people short this area and that the stops were sitting right there. I wanted to be on that move for the break but was tied up with work all day. We broke above in fast trade as expected and tested the next level above at 1355-1357. At this point it was too late in the day to take any more trades.

(Trade plan review). In my trade plan I was expecting the intermediate term swing low to have been put in and it appears that it has. I was also looking for a break out after having the inside day yesterday and with globex trading higher most of the night. I was looking to buy PBs into support and that’s exactly what happened. I was also looking to be a seller at initial resistance at 1351-1353 level on first test and we got a small rotation followed by a bigger rotation for 3 points. I was expecting a balanced session to take place and we got a balanced session. We did have breaking value today which is a sign of the bulls taking control. So I will continue to monitor tomorrow to see what develops.

Trades review: (Hypothetical trades) #1 There was a long at support first thing in the morning at 1346.25 support/previous day’s highs. #2 could have sold the 1351-1353 area on the negative tick and VB divergence. 3# could have bought at support at 1348 on second test. 4# could have bought the break out at IBH at 1351. (Actual trades) I had one trade today. I was long at 1349 and tried for 2-3 points. The market pulled back a little more than I expected but my 2 point stop kept me in and I was able to take a BE scratch. I liked the trade still but couldn’t stay around to manage it properly. So I waited for something else to set up later. I missed any good opps today due to personal issues. Maybe tomorrow will be a better day for me to trade.

1st trade: Long at 1349. I felt good before the trade. I was a little nervous during the trade but I stuck to my plan. After the trade I was clear of my emotions from the failed trade.

Conclusion of the day and thoughts going forward: Looking for more upside tomorrow. Will be looking to buy PBs

Grades:

Following my plans: A

Following my rules: A

Trade execution: C a little too early. And if I liked it I should have stuck with it. It ended up being a good trade.